A Promissory Note is an important legal document. This document outlines the details of a loan that the lender has provided to the borrower. Words, it is a promise that the borrower made to pay back the amount of the loan to the lender in small installments. This document includes all the terms and conditions to reduce the risk of future disputes that may arise because of any confusion. That’s why promissory note templates are very important in our daily life.

After signing this document, the borrower receives the loan and agrees to pay back the loan amount according to the specified terms and conditions. The lender can collect the interest as a lending fee from the borrower and the borrower cannot deny it. This promise forces the borrower to pay back the whole amount to the lender in the agreed time frame. Otherwise, by using this agreement, the lender can take legal action to get his amount back.

Guidelines to Prepare a Promissory Note:

Terms and Conditions:

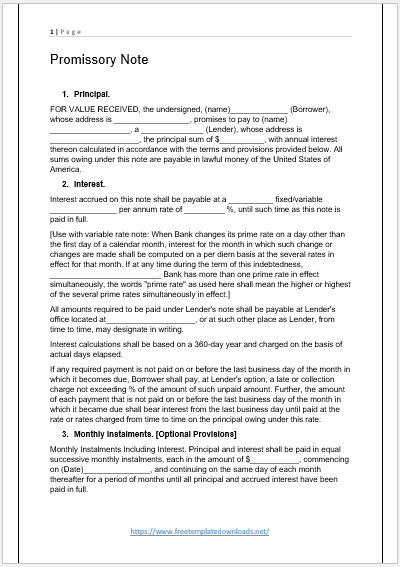

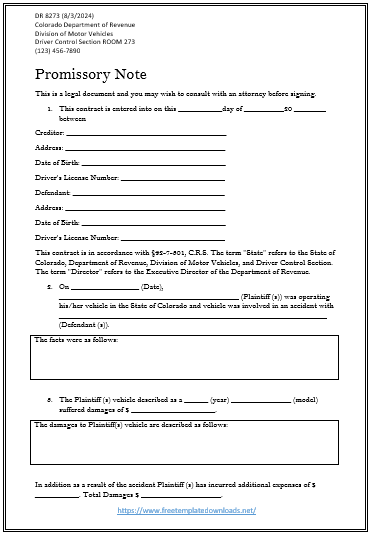

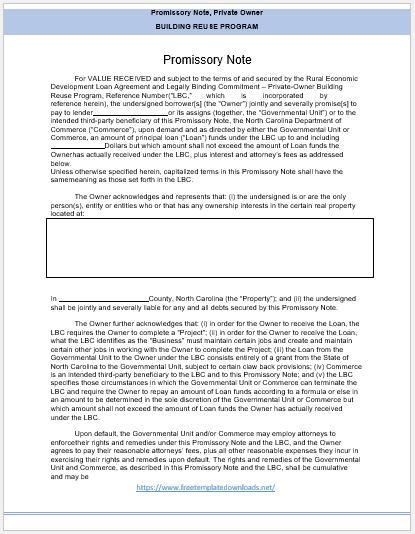

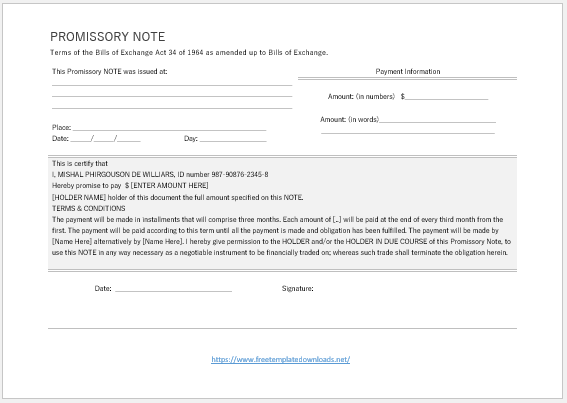

This is the main part of a promissory note. In this section, the lender and the borrower sit together to add mutually agreed terms and conditions to a note. This is necessary to define the amount of loan, interest rate, late fee penalties, security deposit, terms of repayment, default clause, and the name of the co-signer that will pay the installment if the borrower cannot pay back the installment.

Credit Report:

Before making any type of agreement, this is very necessary to run a credit report. Because it will let you know if the borrower has any hidden debt. If the debt is for child support, then it will have superiority over the promissory note and it will not be a good thing for the lender. Keep in mind if you want to run someone else credit report, then you have to get legal written permission.

Security:

The red flags on the credit report alert the lender to demand security from the borrower. This security should be written on the promissory note to save the amount of the loan. This security could be a vehicle, property, or a cosigner who will be responsible for the amount of the loan. If the borrower does not pay back the loan amount, then the cosigner will pay the loan back to the lender.

Language and Tone:

After being agreed upon all the terms and conditions, now is the time to write the promissory note in a well-organized manner. Use professional language and tone. Never use casual language because it will not provide any professional look and will put a negative impact. This is a legal document, so it is necessary to use professional language.

Monthly Installment:

Add some mutually agreed rules and regulations to pay back the amount of the loan. Both parties should sit together and decide on the monthly installment. It is necessary for both parties to agree on the monthly installment amount. Decide and write the date of each month upon which the borrower will pay the installment. Write the amount of the late fee that the borrower will pay to the lender if he cannot pay the installment on time. Add criteria for the payment of a fine in the case of late payments and get the consent of the borrower upon it. Because it is necessary for both parties to agree upon all the terms before signing the promissory note.

Define some legal actions that the lender will take against the borrower if the borrower fails to pay back the amount of the loan. Discuss these terms with the borrower so he can understand that he has to pay back the amount of the loan. Otherwise, the lender will take strict legal action against him to get his money back.

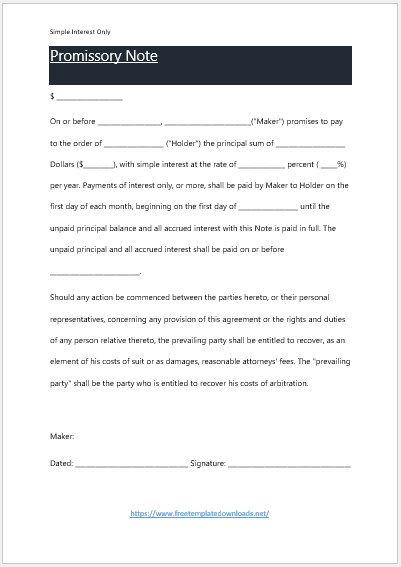

Creating a promissory note is not a big deal. You can use templates to prepare a promissory note. It will save you time and effort. To help you out, we have posted some free and professional promissory note templates in this article. Anyone can download and use these templates as per their need.

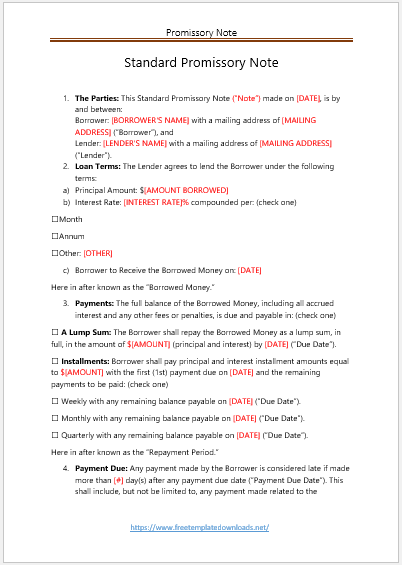

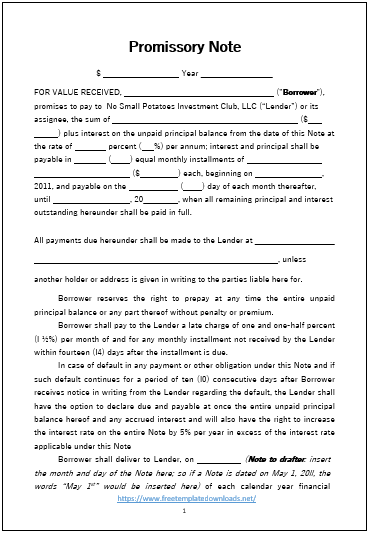

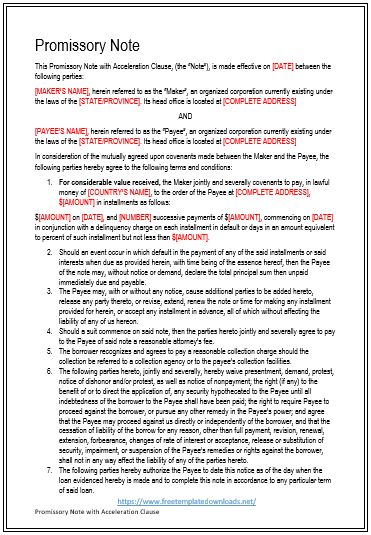

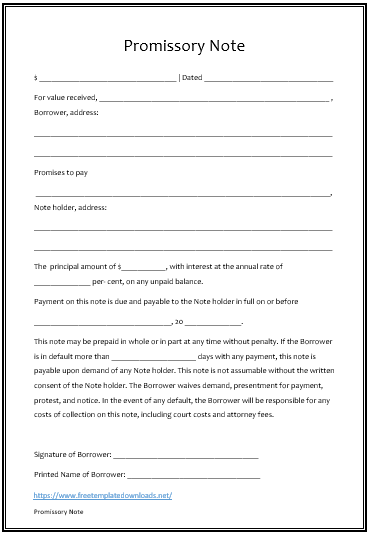

Free Promissory Note Templates

Here are free Promissory Note Templates to help you out in your own way of writing such as legal notes.