There are no assets with a higher inherent risk of theft than cash. Because of this, it is important to have strong internal controls in place to protect cash payment receipts. The cash payment receipt from the seller to the buyer or the customer or the client. It is important to be very careful while filling in the receipt as any miscalculation can lead to a dispute that spoils the reputation of that very person.

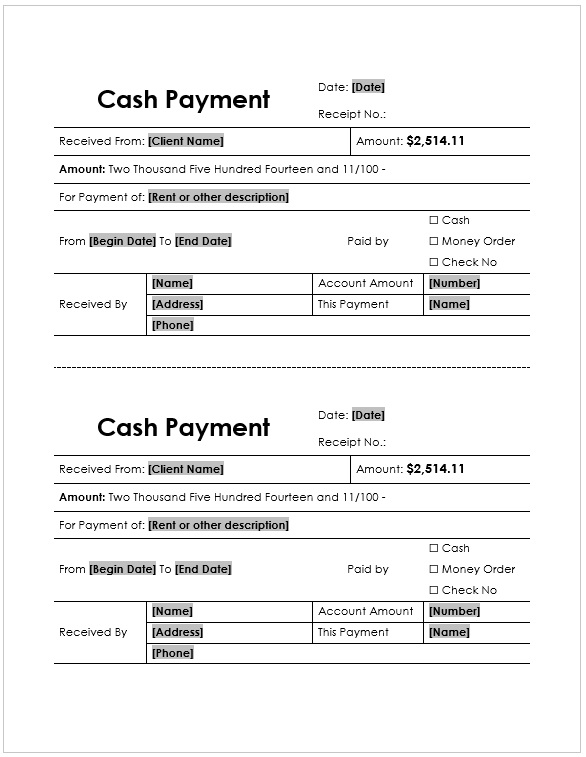

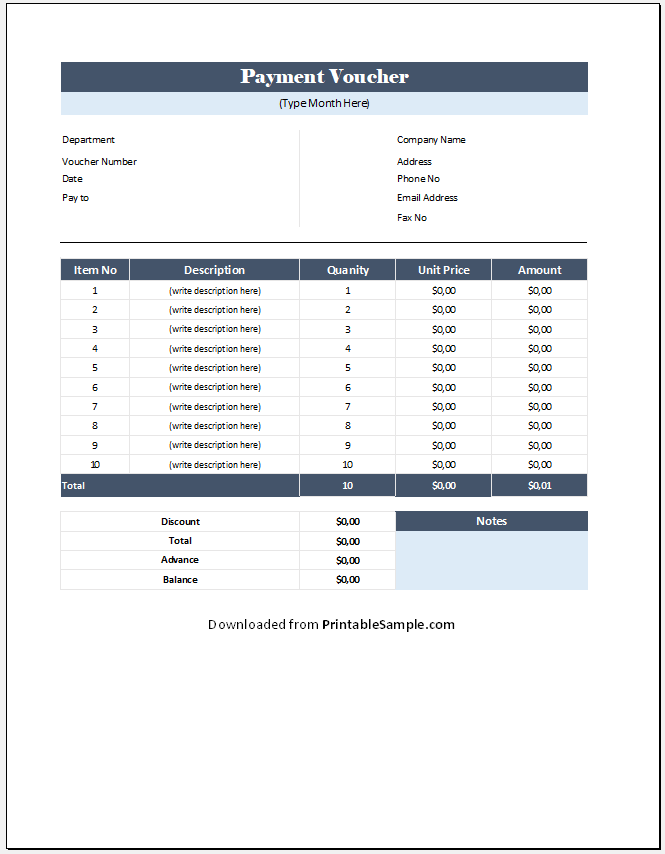

The cash payment receipt has all the details of a customer that he/she bought from you. It is for the record-keeping purposes. So, the cash payment receipts have certain very essential parts. At the top of the receipt, there is the name of the store, company, organization, institution, etc, along with the location of it, and the date and time of making of receipt. After this, the main part of the receipt comes in. It includes all the items being purchased by the customer. The detailed description of each of them along with the quantity of each item. After this, the total amount section is present. It also includes the amount of each item.

Cash payment receipts are not the only way of receiving cash from a company. Many companies may also use mail services to collect cash in return for products and services. The customers mail in cash and check for payments in accounts.

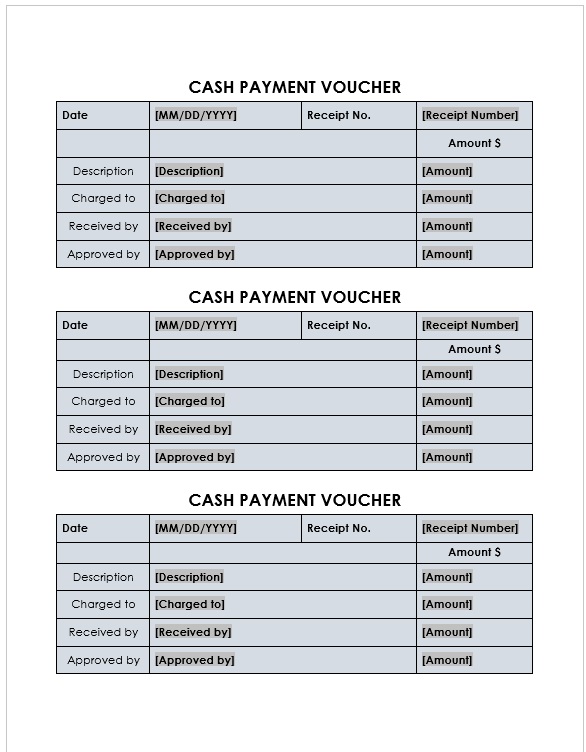

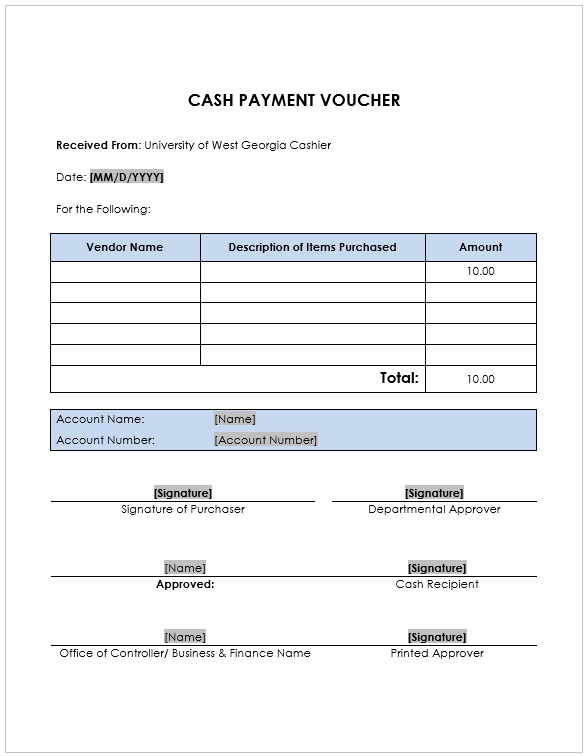

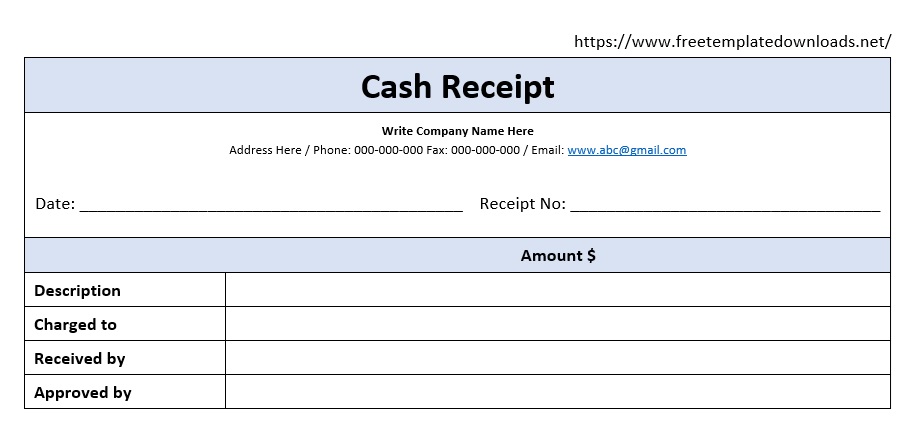

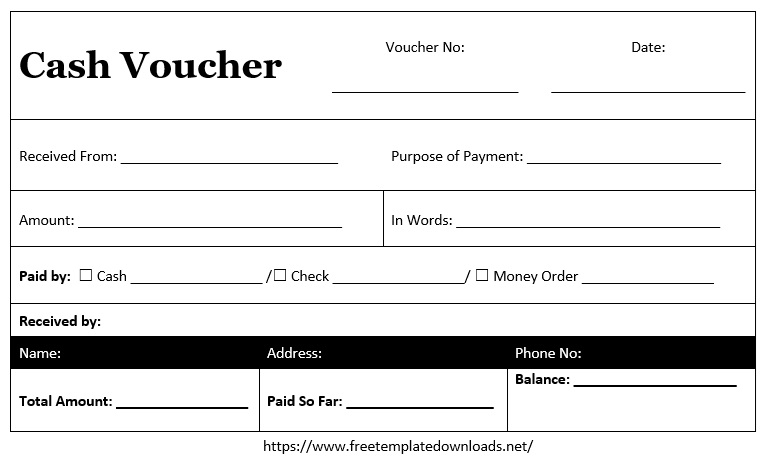

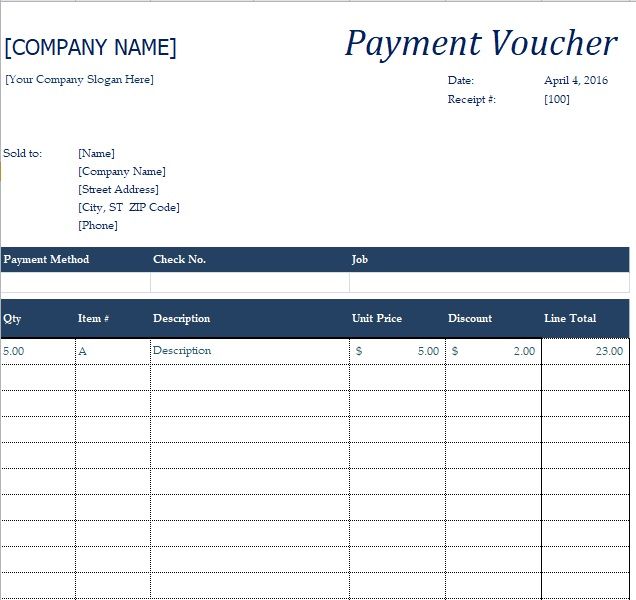

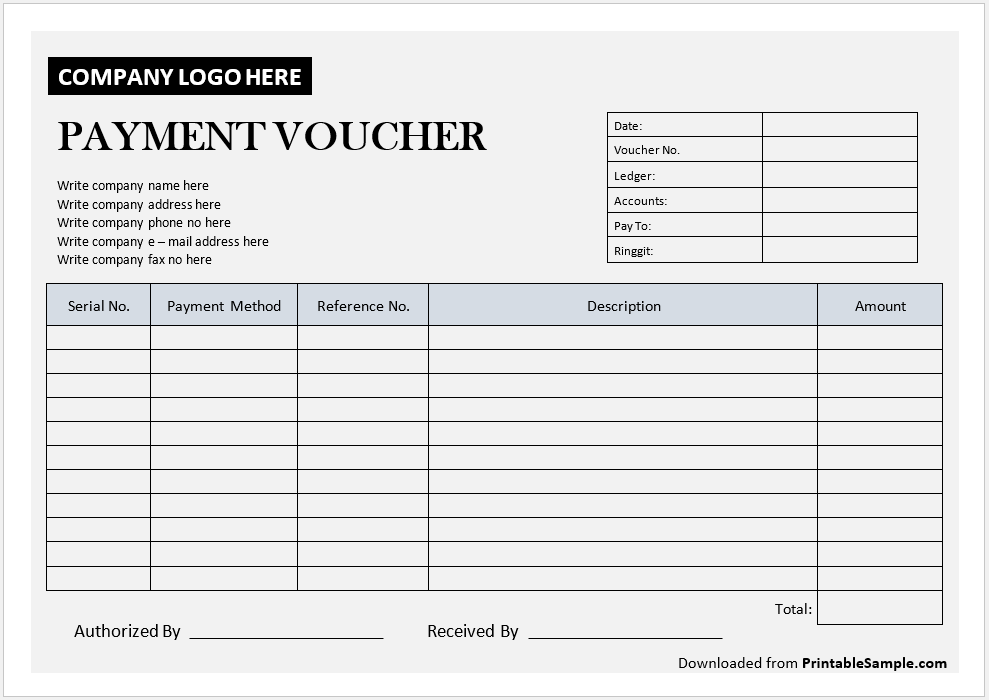

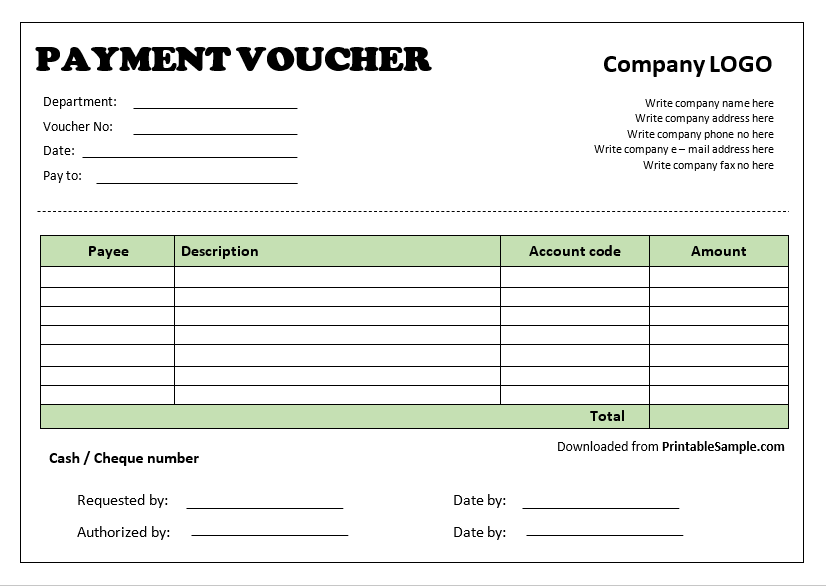

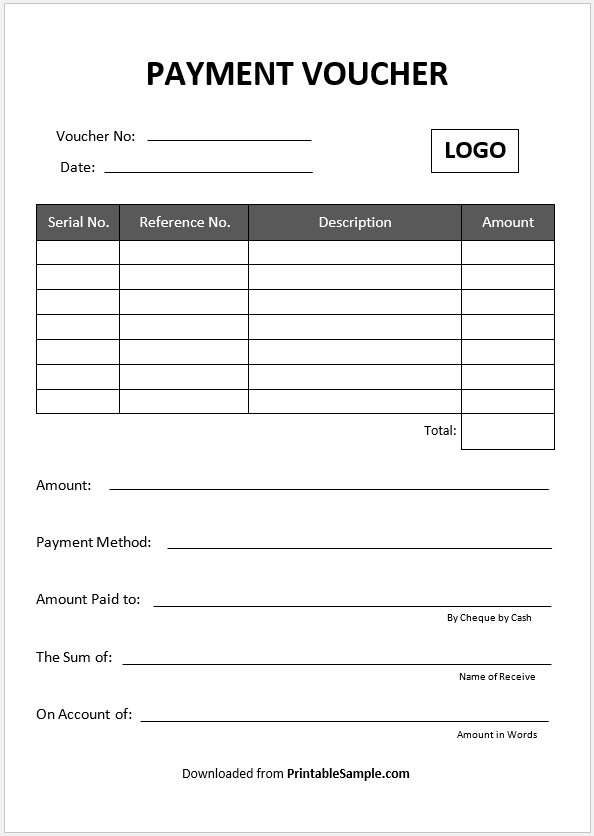

Here we are going to share with you several useful Free Payment Voucher and Receipt Templates for your quick assistance.

As with any other accounting system, there are many problems attached to the cash payment receipt. It is very important to have an efficient system to control the losses as a result of these problems.

Control of Cash Payment Receipts over the Counter:

When a company sells goods for cash over the counter, just like in a retail setting. They are at risk of theft. In order to control that they can use the following procedures.

- The cash payment receipts for each transaction record the cash received for it. At any point, the actual cash can be found by comparing it to the receipt records to see the imbalance.

- The cash drawer is open only when there is a new transaction. This system is very useful for solving this problem.

- At the end of the day, the total cash is compared to the total receipts. It will calculate the difference very quickly and easily.

- There must be an accounting department where further records of cash payment receipts are present. The register tape is sent to them. If there is any difference after their evaluation then investigation could be the next step for finding out the thief.

Therefore, it is now clear that good control over the cash payment receipts is a separation of duties. The person receiving the cash is not necessarily the person who is entering the amount into the accounting system. The cash basically goes to another department and then at the end, an audit is done to make sure that the deposits in the bank for a particular month are the same as those recorded in the cash ledger.

Cash payment receipt documents that prove that a payment has been received from a particular entity. An entity can be a person, firm, or organization. Different transactions can use cash payment receipts but it totally depends on the type of payment. It involves the transfer of cash or cash equivalency. The cash payment receipt has two copies each, the original one is given to the customer, and the other is kept by the seller for accounting purposes. In other words, we can say it is a piece of paper that is accepted by an organization whenever cash is received. Payment can be from anyone, for example, an investment, customer, bank, etc. This cash is acknowledged when balancing the account receivable cash whenever a transaction happens. We can also say that it is a balance that increases cash in the balance sheet.

This is not only called proof of any payment but can be used for many other purposes like when a customer wants to exchange any item a cash receipt is demanded from them as proof, when a customer complains about any purchased item, when there is any warranty issue or when any other information is needed against that payment then cash payment receipts are used.

Another basic use of cash payment receipts is the balancing of the accounting records. One of the major audit issues is the lack of cash receipts so, it helps to reduce and avoid the audit issues. Without cash receipts, the audit is incomplete which results in serious issues.

Another important point of cash receipt is that it is useful for tax purposes where it helps to minimize the tax payable. Cash payment receipts are used as expenses which are deducted from sales. As we know cash receipts are important for both vendor and customer. For vendors, it helps them to know exactly how much of is goods are sold and how much of the goods are needed, and for customer it helps to keep track of the financial records.

There are some important cash payment receipt guidelines that set a base on which they are built. First of all, it includes the business name and address which is mentioned at the top of every cash receipt but sometimes it is mentioned somewhere in the end. It is important to have a business name and address so it is easy to go there whenever there is an issue.

The price of the goods purchased should also be mentioned there with all other billing details. Cash payment receipts should also mention all the things the customer has bought with the price of each item mentioned. This covers a major area in receipt which clearly tells the customer what was bought and at what price it was bought. It also mentions the services provided to the customers in the form of clauses and also includes some company policies which are linked with the payment like how many days an item can be exchanged or claimed.

Under the position where the price of each item is mentioned, there are subtotal, taxes, and total mentioned. Subtotal is the total of all the goods purchased before taxes are applied to them. Under the subtotal section, there are tax sections that include tax details. It includes the amount of tax charged on purchases. Under the tax section is the total section which includes total payment after taxes applied. This is the amount that the customer pays.

The last and most important is the transaction sections which clearly tell how much the customer paid and what the change is. This section also refers to any inappropriate change given. There is a transaction number in this section which is kept in the record of the vendor so that the vendor can easily open if there is any issue.

Here are more templates for your quick review from templatehub.org,